Invest Passively in a Growing Portfolio of Real Estate, Hands Free

Earn Stable Monthly Returns with District REIT™

11-13%

Targeted Total Annual Returns*

8%

Current Per Annum

Distribution Paid Monthly

+ Capital Appreciation

District REIT investors can own a portfolio of diversified income-producing real estate, without the hassles of property management.

Unitholders benefit from the capital appreciation of District REIT’s assets through on-going management and value creation strategies.

10% Unit Price Increase in 2023

In 2023, Unitholders principal investment increased by 10% due to asset appreciation of the portfolio

With an average return of 13.33% for 2020-2022†

15.35% Average Return Over Past 5 Years ****

Features

Registered Funds Eligible

(RRSP, RRIF, RESP, TFSA)

DRIP

(Distribution Re-Investment Plan) with a 2% Unit Bonus**

$10,000

Minimum Investment

Well-Managed Real Estate Portfolio

Learn more about District REIT featured in this informative webinar from the 30 Minutes to Wealth real estate talk show

Key Fund Benefits

***Subject to limitations. See Offering Memorandum for full details.

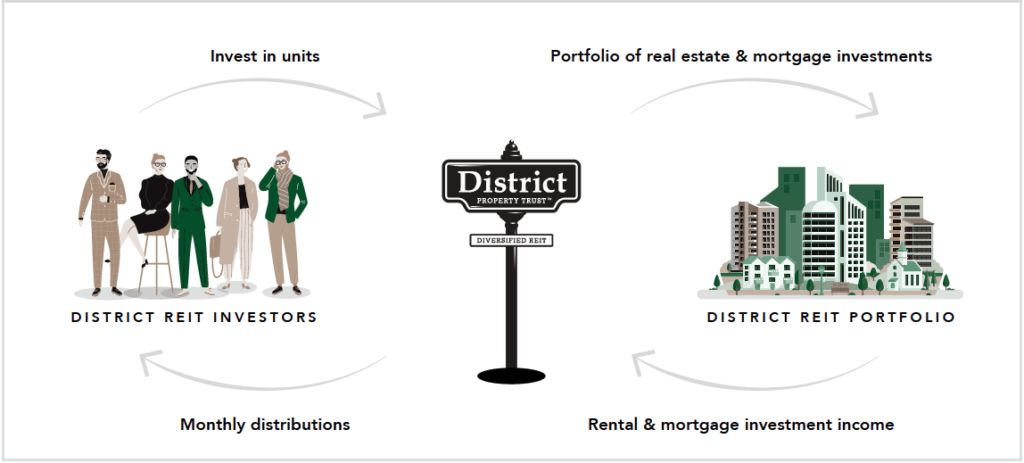

District Property Trust, also known as District REIT™, is a private Real Estate Investment Trust that owns and operates a portfolio of diversified income-producing real estate.

District REIT’s Unique Collaboration

District REIT is part of the One Real Estate Enterprise group of companies, and works closely with its affiliated company Valour Group, to identify first-hand opportunities to purchase completed projects for the REIT. This strategic and unique relationship has the potential to offer the REIT primary access to purchase off-market, newly constructed developments, in targeted locations.

MULTI-RESIDENTIAL

COMMERCIAL

INDUSTRIAL

Sign Up To Learn More!

To provide your consent to receive additional information regarding these, and/or other related investments from Startly in respect of opportunities offer by One Real Estate Enterprise group of companies (including, Valour Partners and District REIT), please subscribe by clicking on the subscribe button below and provide the below information.

Marketing emails after you subscribe will come from: Startly Inc., 5700-100 King Street West, Toronto, ON, M5X 1C7, https://www.startlyportal.ca. You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email.

*No assurances can be given that the Target Return or Target Portfolio Appreciation will be achieved; see the full offering materials for detailed terms and conditions.

**Investors that elect to participate in the DRIP should consult their own tax advisors for advice with respect to the income tax consequences of participating in the DRIP.

****Assuming an investment was on DRIP, and was invested 5 years ago, the average annual return was 15.35% or 1.28% monthly. This assumes the compounding impact of the DRIP and the price increases seen since 5 years ago.

† Note that these refer to past results for a particular year, and in all cases where historical performance is presented, past performance may not be a reliable indicator of future results and there can be no assurance that the District REIT will be able to achieve comparable results to any of those summarised herein. Actual results may vary materially year-over-year.